BREAKING: Twitter Files Reporter Reveals IRS Paid Him A Visit On The Day He Testified Before Congress

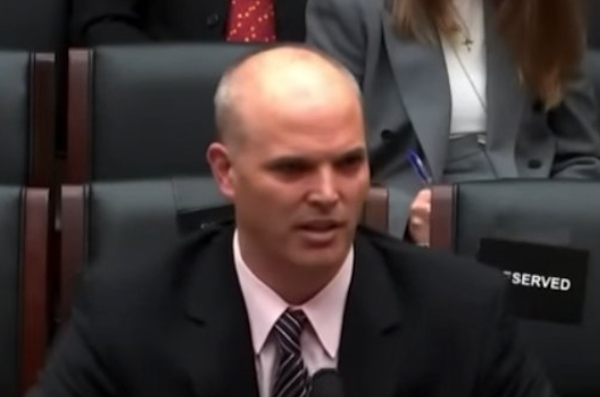

Twitter Files reporter Matt Taibbi disclosed on Wednesday that the IRS paid him an unexpected visit on the same day he testified before Congress.

As a response, House Judiciary Committee Chairman Jim Jordan has sent a letter to IRS Commissioner Werfel, expressing his concern over the situation.

The IRS schedule their unannounced visit on March 9, 2023, the same day Taibbi testified before the Select Subcommittee on the Weaponization of the Federal Government on his findings about the influence of the federal government on technology companies.

In a Twitter thread, Taibbi explained that in December 24, 2022, a Saturday and Christmas Eve, the IRS assigned a “new date” to his case, coinciding with the publication of “Twitter and Other Government Agencies.”

The IRS gave a new “assign date” to my case on December 24, 2022, a Saturday and Christmas Eve, the same day “Twitter and Other Government Agencies” was published: https://t.co/YQ9ZpnOUsJ pic.twitter.com/1l3AwdKpyn

— Matt Taibbi (@mtaibbi) May 24, 2023

He clarified that he did not file his taxes late and that the IRS conducted an investigation that involved multiple searches of commercial records and even checked if he possessed hunting and fishing licenses or “a concealed weapon.”

The IRS investigation of me included mutliple commercial records searches and a check to see if I had hunting and fishing licenses or “a concealed weapon”: pic.twitter.com/5IX7AU0i42

— Matt Taibbi (@mtaibbi) May 24, 2023

Interestingly, the IRS initiated the case on Christmas Eve, 2022, which happened to align with a significant report on FBI/intelligence community connections to tech platforms in the Twitter Files. This information came to light through a recent letter from the House Judiciary Chair to the IRS Commissioner.

The IRS opened a case on me on a Saturday, Christmas Eve 2022, which just happened to coincide with a major Twitter Files report on FBI/intelligence community ties to tech platforms.

This is revealed in a new letter to the IRS Commissioner by House Judiciary Chair @Jim_Jordan: pic.twitter.com/WnbouNJMdQ— Matt Taibbi (@mtaibbi) May 24, 2023

In the letter to IRS Commissioner Daniel Werfel, Jordan wrote, “The Committee on the Judiciary is investigating the circumstances of the Internal Revenue Service’s (IRS) visit to the home of journalist Matt Taibbi on the same day that Mr. Taibbi testified before the Select Subcommittee on the Weaponization of the Federal Government.”

The letter further highlights the IRS’s claim that they sent letters to Taibbi regarding his 2018 tax return. However, Taibbi and his accountant never received these letters or any other notification of an issue with the tax return.

The letter stated, “According to Mr. Taibbi, neither he nor his accountant received either of these letters or any other notification that there was an issue with his 2018 tax return that is, until the IRS conducted a field visit at Mr. Taibbi’s home three years later.”

The timing of the IRS visit is of particular concern. As the letter points out, “The IRS’s production confirmed one crucial fact that Mr. Taibbi did not owe the IRS anything. Rather, the IRS owed Mr. Taibbi a substantial refund.”

After the IRS’s field visit, Mr. Taibbi promptly resolved his 2018 tax filing on March 21, 2023. On March 23, 2023, the IRS sent Mr. Taibbi a Notice of Case Resolution, informing Mr. Taibbi that his case had been closed and that no taxes or tax returns were due.”

It’s worth noting that Joe Biden nominated Werfel in November of 2022, as the Commissioner of Internal Revenue. Following that, on March 9, 2023, Werfel received confirmation from the Senate. He took the oath of office on March 13, 2023, administered by the deputy commissioner and former acting commissioner Doug O’Donnell.